is new mexico tax friendly for retirees

State income tax. Silver City is a college town in western New Mexico.

New Mexico Retirement Tax Friendliness Smartasset

For nature lovers and those looking to retire in a place that offers the feeling of being far away from the rat race this may be the place.

. New Hampshire only taxes certain amounts of dividend and interest income. 172 Property tax ranking. 323 on all income but Social Security benefits arent taxed.

Starting in 2022 all military retirees may exclude 50 percent of their military retirement benefits New Mexico. Social Security retirement benefits are taxable in New Mexico but they are also partially deductible. Taxable as income but low-income taxpayers 65 and older may exempt up to 8000 of income from New Mexico taxes.

See our Tax Map for. 800-352-3671 or 850-488-6800 or. New Mexico is moderately tax-friendly for retirees.

162 of the AZ population is 65 and over in Nevada that percentage is 146 New Mexico is next with 134 and Utah is much younger with only 103 of the population in that age bracket. It also comes in fourth in terms of recreation centers with 098 per 1000 residents. The exemption amount is increased to 20000 for.

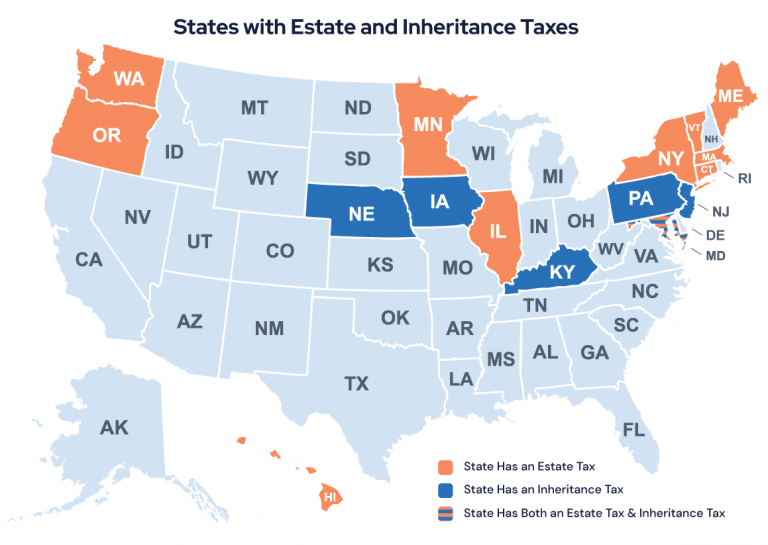

New Mexico is moderately tax-friendly for retirees. Property tax exemption for seniors 65 and older or surviving spouses 50 of first 200000 in actual value exempt No estate or inheritance tax. Flat 463 income tax rate.

1 for immediate. 55 Mean property tax rate as a percentage of mean home value. In this case the state is coming in at 6 due to it being quite tax friendly for retirees.

The average home in New Mexico costs. Population and income data is from American. Seven states have zero state income tax including texas and nevada and 13 states give retirees a break on their social security and pension income including new mexico.

Retirement income tax breaks start at age 55 and increase at age 65. Every form of retirement income including Social Security is liable to tax at rates of up to 49 in New Mexico but lower-income seniors can deduct 8000 from their annual bill. Depending on income level taxpayers 65 years of age or older may be eligible for a.

However many lower-income seniors can qualify for a deduction that reduces this overall tax burden. Up to 10000 of military retirement pay is exempt from tax for the 2022 tax year. Does New Mexico offer a tax break to retirees.

There are also no taxes on Social Security benefits pensions or distributions from retirement plans nor are there estate or inheritance taxes. Does New Mexico offer a tax break to retirees. New Mexico is renowned for its low cost of living about 31 lower than the national average.

Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each. 404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes. Is New Mexico Tax Friendly For Retirees.

A one-time refundable income tax rebate of 500 for married couples filing joint returns with incomes under 150000 and 250 for single filers with income under 75000 which will save New Mexicans about 312 million. California will tax you at 8 as of 2021 on income over 46394. The exemption gradually phases out as income rises and it disappears for single filers whose federal adjusted gross.

Retirement income exclusion from 35000 to 65000. For seniors age 65 or older there is an 8000 deduction on retirement income if the household adjusted gross income AGIis less than 28500 for single filers 51000 for married people filing jointly and 25500 for married taxpayers filing separately. It ranks towards the middle of this list with a tax rate of 1760.

Social security income is partially taxed. Average property tax 607 per 100000 of assessed value 2. New Mexico has a low population coming in at just over 2 million people making it a great choice for seniors looking to escape the more densely populated and popular retirement states of New York Florida and Arizona.

Youll get the opportunity to breath and enjoy the raw beauty of nature. Missouri Montana Nebraska New Mexico North Dakota Rhode Island Vermont West Virginia and Utah. The exemption is 2500 for taxpayers under the age of 65.

Income taxes in the 42 other states can vary widely. Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax-friendly states for retirees. New Mexico does tax Social Security income which is a drawback though some households may qualify for senior deductions and exemptions.

Employer funded pension plans exempt these self-funded plans may be fully or partly taxable. 246 - 684 State sales tax. A new refundable child tax credit of up to 175 per child which will save New Mexico families 74 million annually.

A 1 tax on interest and dividends has been eliminated starting in the 2021 tax year. 29 on income over 440600 for single filers and married filers of joint returns 4 5. The town ranks third among the best places to retire in New Mexico when it comes to medical centers with 285 per 1000 residents.

Low Cost of Living. Its important to note that New Mexico does tax retirement income including Social Security. The age statistics suggest that Arizona Nevada and New Mexico are much more popular for retirement than Utah.

Beginning in 2020 West. Most tax-friendly states for retirement retirement communities and Most tax-friendly.

The Most And Least Tax Friendly Major Cities In America

22 Maps That Explain America Map Economic Analysis America

Montana Retirement Tax Friendliness Smartasset

The Least Tax Friendly State In America Income Tax States In America Income

The Best States For An Early Retirement Health Insurance Life Insurance For Seniors Early Retirement

A Guide To The Best And Worst States To Retire In

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Mapsontheweb Infographic Map Map Sales Tax

10 Most Tax Friendly States For Retirees Best Places To Live Us Map Retirement

The Most Tax Friendly States To Retire Cheyenne Wyoming Wyoming Best Cities

U S Spends Comparatively Little On Public Disability Benefits Budgeting Disability Public

New Mexico Retirement Tax Friendliness Smartasset

A Guide To The Best And Worst States To Retire In

New Mexico Retirement Tax Friendliness Smartasset

A Guide To The Best And Worst States To Retire In

Minto Communities Florida Communities Retirement Communities Minto Retirement Community Florida

Pin By Jon Schlussler On Texas Houston Neighborhoods The Neighbourhood Texas